The eighth wonder of the world

Neither of these attitudes leads to financial success: Saving money is a marathon. The success of investing only becomes visible in the long term, as short-term market fluctuations can distort the picture. But long-term saving and investing, when done right, is immensely powerful!

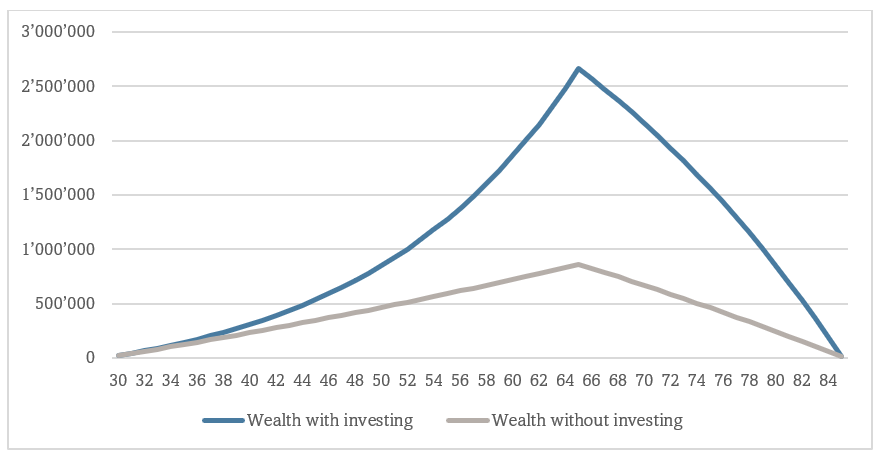

An example: A self-employed person starts putting aside CHF 20,000 every year from the age of 30. If the money is placed in a bank account earning 1% interest, the person will have about CHF 860,000 by the age of 65. The person can then withdraw CHF 47,000 a year from this reserve until the age of 85. That is the success of saving.

Albert Einstein called compound interest the eighth wonder of the world. To benefit from it, you have to invest the money you have saved. If the person in the above example manages an investment portfolio with a net return of 6.5% until the age of 65, he or she will have three times that amount, or around CHF 2,660,000. At retirement, he or she switches to a balanced portfolio with a return of 3.5%. The person can then withdraw CHF 187,000 a year until the age of 85. This means they can spend four times more each year than if they had not invested.

This shows: Long-term success doesn’t require a secret investment tip or a large inheritance, but depends on rigorous discipline to hold back from spending today and invest the money instead.