Gold is not the only thing that glitters

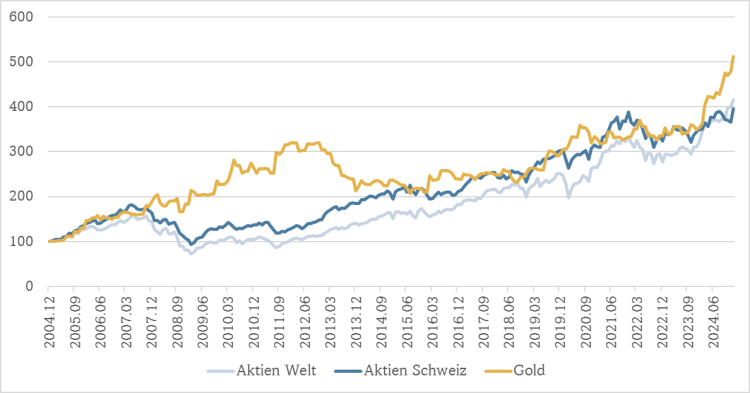

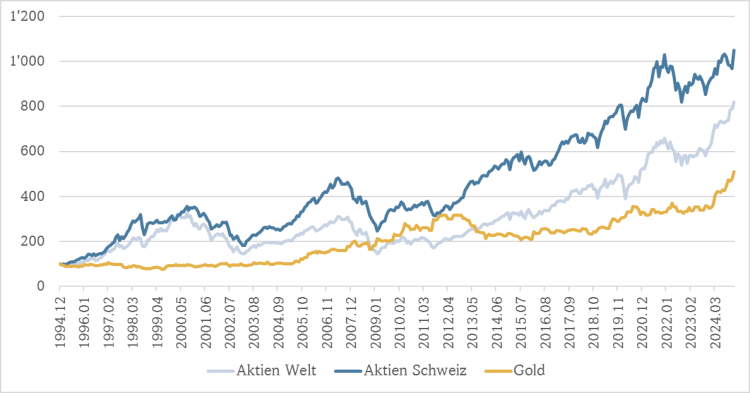

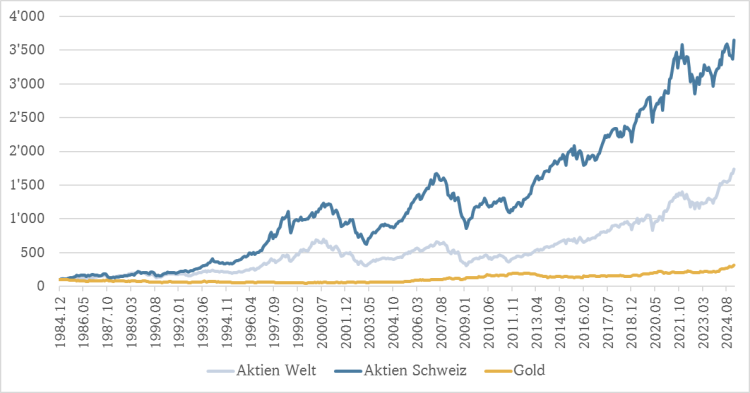

The current high and the rise in the price of gold in 2019 and 2020 make it appear just as profitable as equities in a 10-year comparison. And it looks even better over 20 years, as shares were held back by the global financial crisis during the same period.

Annual returns on gold and equities in Swiss francs

|

Period |

Global equities |

Swiss equities |

Gold |

|

10 years (since 2015) |

9.5% |

6.5% |

8.0% |

|

20 years (since 2005) |

7.3% |

7.1% |

8.5% |

|

30 years (since 1995) |

7.2% |

8.1% |

5.6% |

|

40 years (since 1985) |

7.4% |

9.4% |

2.9% |

|

50 years (since 1975) |

8.8% |

9.5% |

3.4% |

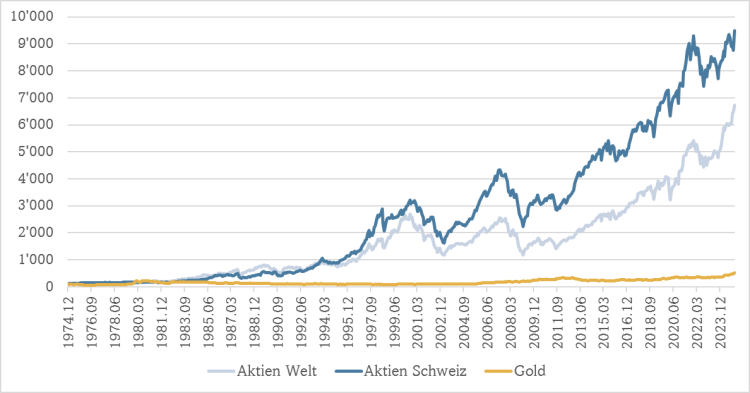

But if you broaden your perspective and ask how money can be invested for decades and generations in real assets that generate returns, you will come to the conclusion that productive capital in the form of equities is the ‘gold standard of capital investment’. Viewed over a 50-year time span, the annual return on equities is over 2.5 times higher than on gold. An original investment of CHF 100 would have grown to CHF 520 with gold, but to almost CHF 9,500 with Swiss equities – so an increase by a factor of 18!

10 years

20 years

30 years

40 years

50 years